Client lifetime value is a projected figure intended to predict the overall monetary value of a new acquired customer throughout their “lifetime” with the company – the period of time they are estimated to remain onboard. It is based on a certain projection model.

Such a projection model typically:

- Tries to assign a “bucket” for the customer – a group of customers with similar attributes

- Uses past data from similar customers including spending, growth potential and churn patterns

Through statistical extrapolation, the model will evaluate the “overall net value” of a client – how much will the client be worth to the company in total, over time. This is critical for companies engaged with online marketing. Why? Because that’s the only way they can tell how much they can afford to spend on acquiring new customers, or in short – setting an informed CAC (customer acquisition cost) target.

B2B LTV

In B2B, it’s a little more complex than in B2C context. In B2B marketing, the initial registration / license may be small, but, can grow fast due to :

- One team within the company testing the product. If test is successful – number of seats will be multiplied

- A small startup is growing fast and accordingly goes to larger tier / needs more seats…etc.

B2B also has its unique attribution challenges whereas one person in the organization might test drive the tool, but the actual sign up might come from the finance team…etc.

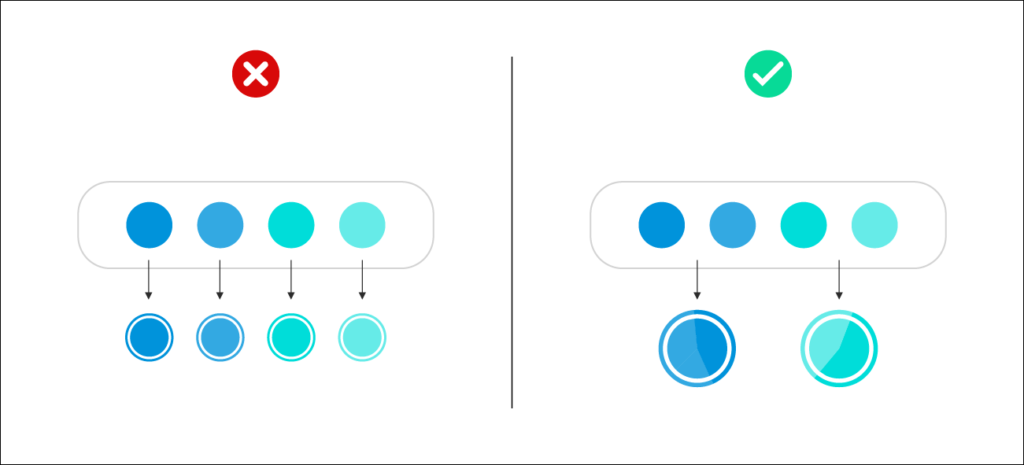

A solid CLV model will take into account different client segments (country, initial plan, initial purchase amount, number of employees in the organization among others). By applying a certain logical breakdown to segments / buckets, a model can achieve more precision.

But, It’s important not to go “over the bar” with granular breakdown, as too granular segments would not yield enough data for a statistically reliable projection.

For example, looking into each country in the world as a client segment of its own might be too granular. If the number of acquisitions in each EU country is too small, its better to cluster them into larger buckets, for example, large countries like the UK, Germany, France separately, and then a bucket for the rest of west EU, and a bucket for east EU. depending on acquisition numbers, sometimes even this might be too granular and its best to start with just West Eu / East EU breakdown. over time, more data is accumulated & it makes sense to further break out more countries into their own segment.

The challenge of B2B Marketing – smaller dataset

Established large consumer businesses such as telcos, banks, insurers, …etc. have tons of historic data on clients, thus, can accurately predict CLV within different client segments. Furthermore, they usually operate within 1 or few core locations and know them very well.

In contrast, online-centric businesses & tech startups face a few challenges in building their own CLV projection model:

- They lack significant historic client activity data.

- They usually target many geo locations, possibly with very different CLV patterns.

- They operate within dynamic markets, more susceptible to shifts, changes and surprises.

If you build it – will they come?

As explained in Peter Thiel’s iconic book “zero to one”, the answer is no. Important as they may be, relying on organic efforts, earned media and so forth is not a viable strategy for online companies in 2021. Companies must have a strong paid acquisition arm, i.e. online advertising, partner program, media buying and so forth.

In order to operate paid acquisition strategies effectively, companies must have at their baseline a projected CLV. Otherwise – how will they be able to decide how much to spend on acquiring new customers? estimate too high, and you might be losing money on each new client you acquire. Estimate too low, and you’ll be under-spending, leaving valuable clients on the table.

Common pitfalls to avoid

Overly defensive approach – if you’re unsure about CLV, you might take an overly defensive approach. For example, you might evaluate a certain segment’s CLV to be 6 month’s worth of income from a subscription customer, even though you already know that most of your customers stay onboard for more than a year. Surely, at acquisition time you don’t know enough about this particular customer behavior. But, unless you have solid reason to believe it a lower CLV segment – assume by default it will be your average customer value.

Next: frequent changes in your CLV projection – models have to sometimes be tweaked and adjusted to reflect the most updated data. Just make sure that you don’t change your estimates too often – creating distrust in the figure and resorting again to a defensive mode which will cost you in slow growth and low market share.

Time or Money?

Overall, in paid online acquisition there is a certain tradeoff between time & money. If you spend wildly, you’ll learn quickly your CLV by acquiring many customers in a relatively short time span, and learning their behavior relatively fast. In that case, you might be losing in the short term for each acquired customer. The other extreme, taking it slowly with an overly defensive approach will probably get you profitable on the basis of net unit economics, but will result in slow growth. Considering a company also has fixed costs to bear, in most cases this approach is even worse than overspending.

Finding the optimal ROI point isn’t easy, but that’s where you should aim and constantly work for.